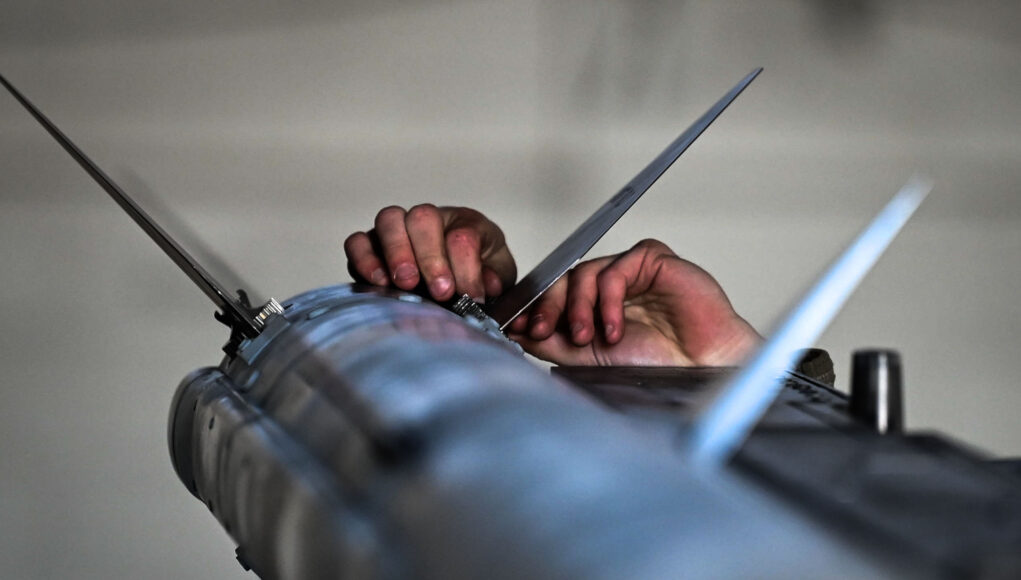

The United States State Department has approved a possible Foreign Military Sale to Australia involving AIM-120C and AIM-120D Advanced Medium Range Air-to-Air Missiles (AMRAAMs) and related equipment, the Defence Security Cooperation Agency announced on 9 April 2025.

According to the statement, “the Government of Australia has requested to buy up to two hundred (200) AIM-120C-8 Advanced Medium Range Air-to-Air Missiles and up to two hundred (200) AIM-120D-3 AMRAAMs.”

The package also includes containers and support equipment, spare parts, consumables and accessories, classified software and documentation, transportation, studies and surveys, and associated engineering, technical, and logistics support services. The estimated total cost of the deal is $1.04 billion.

The State Department said the proposed sale “will support the foreign policy and national security objectives of the United States,” noting that “Australia is one of our most important allies in the Western Pacific.”

The release touched on Australia’s strategic role, stating that its position “contributes significantly to ensuring peace and economic stability in the Western Pacific,” and that “it is vital to the U.S. national interest to assist our ally in developing and maintaining a strong and ready self-defence capability.”

The agency further stated that the acquisition will “improve Australia’s capability to meet current and future threats by protecting and increasing aircraft survivability,” and confirmed that “Australia will have no difficulty absorbing this equipment and services into its armed forces.” The proposed sale, it added, “will not alter the basic military balance in the region.”

RTX Corporation, based in Tucson, Arizona, will be the principal contractor. No offset agreements have been proposed at this time, although the notification notes that “any offset agreement will be defined in negotiations between the purchaser and the contractor.” The sale is not expected to require the assignment of additional U.S. Government or contractor representatives to Australia.

The Defence Security Cooperation Agency concluded that “there will be no adverse impact on U.S. defence readiness as a result of this proposed sale.” Final dollar values may be lower depending on specific requirements and contractual agreements.

Somewhat unclear if these variants of the AIM120 are intended for the RAAF or Army.

The initial standard missile for the NASAMS GBAD system is the AIM 120 and NASAMS can launch both the C and D variants.

The D variant is specifically designed for internal carriage in the F35 and some later versions of the C also have clipped fins necessary for internal carriage plus the AIM 120 is part of the Super Hornets standard load out.

Seems like useful numbers to add to existing AMRAAM inventory but less impressive if shared between Army and RAAF.

Also discussion on ‘offsets’ may lead to potential production/assembly in Australian at Raytheon’s Centre for Joint Integration NASAMS production facility in South Australia.

Yea, the split buy seems odd unless they are for different platforms. My understanding is that C8 and D versions are similar in capability (i think the differences are mostly not in the public domain), but there clearly must be a difference of some sort. I know F35s can operate D versions, but not sure about the Super Hornets.

Everybody can earn 250$+ daily… You can earn from 10000-15000 a month or even more if you work as a full time job…It’s easy, just follow instructions on this page, read it carefully from start to finish… It’s a flexible job but a good earning opportunity..

go to this site home tab for more detail thank you…… 𝐖𝐖𝐖.𝐍𝐄𝐓𝐏𝐀𝐘𝟏.𝐂𝐎𝐌

Agreed, a somewhat puzzling bifurcated acquisition. AIM-120-C8 is an export only variant, which does not utilize the latest System Improvement Program (SIP) 3F software. Acquisition strategy possibly attributable to hardware/software integration issues or funding constraints? Presumably, decision rationale will eventually become self-evident. 🤔

What happens if Indonesia obtains better Russian misilles and aircraft ?