Helsing has announced plans to acquire Blue Ocean, a UK- and Australia-based specialist in autonomous underwater vehicles, to strengthen its Maritime Defence Programme, according to the company.

The acquisition will integrate Blue Ocean’s hardware and manufacturing expertise with Helsing’s artificial intelligence systems. Helsing stated that combining the two firms will “accelerate the development and mass production of autonomous platforms for the protection of the underwater battlespace,” supporting efforts to build “sovereign capabilities across Europe and Australia.”

Amelia Gould, General Manager for Maritime at Helsing, said in the release: “The need for a smart autonomous mass-approach is clear, and together with Blue Ocean we can build an autonomous glider that provides a big leap forward to conduct underwater ISR for navies.” She added that joining forces “makes sense” as Helsing seeks to strengthen its maritime offering for European and AUKUS partners.

Blue Ocean’s Group Managing Director, Mike Deeks, said: “Since first meeting Helsing we have forged a strong working relationship bringing together our Autonomous Underwater Vehicle technology with Helsing’s impressive Edge AI processing to create a highly effective anti-submarine warfare and wide area surveillance capability.” He described these capabilities as “critical to compilation of the modern common operating picture and providing border and asset protection.”

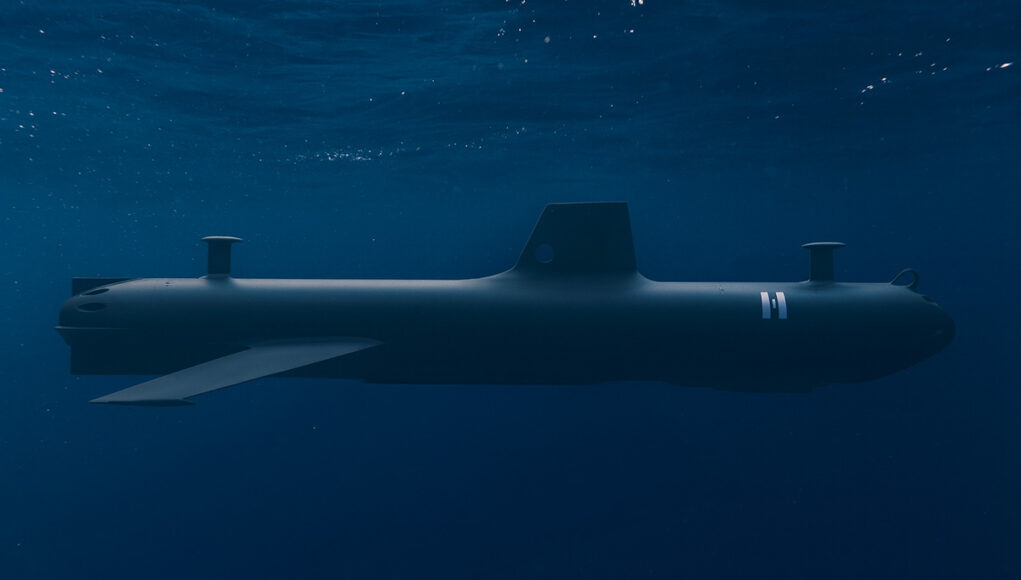

The acquisition follows Helsing’s recent testing of its SG-1 Fathom autonomous underwater glider at the British Underwater Test and Evaluation Centre (BUTEC) in July, and its announcement of a £350 million investment in a new “Resilience Factory” in Plymouth.

The transaction will proceed through a members’ scheme of arrangement under Australian law, subject to court, regulatory, and shareholder approval.

Mixed feelings on this one.

I like Helsing, I like that they’re Euro-centric and I like that they have manufacturing in the UK, to bring capabilities that are cutting edge and needed for the UK and elsewhere- with UK industrial content. Hopefully ITAR-free also.

But I would also have liked to keep a UK firm UK-owned. We let foreign interests buy up our valuable security know-how and tech far too easily.

Won’t be long before RR is bought up, no doubt.

To be far Helsing does have a registered entity in the Uk. The way these multinational defence companies work is to have firewalled registered entities in each of their key markets. It’s like BAE being a British company that owns BAE systems inc,but BAE systems inc is most definitely a U.S. company.

As long as they build factories in the Uk and UK IP is protected by a firewalled UK subsidiary all is good.

Hi Jonathan.

I’m interested to know your take on something, if I may. If the UK was engaged in a conflict that the US was not in support of, roughly how would that impact BAE’s capacity to support such an effort?

It would make little difference other than the fact BAE could simply not take US IP and use it to build stuff in the UK without the permission of the US. Also BAE could not simply build and sell anything with US IP with out permission. But anything with UK ip would not be effected. It really all depends which “nation” developed it.

The curse of ITAR! I’m glad that we (and Europe) have seen the value in producing our own IP so we’re not as reliant on it- and hopefully less and less as we bring more military industry back domestically.

Per your other reply to me, you’re right- Helsing is far from the worst by a long long way. To be fair, they’re one of the best in terms of foreign defence companies operating in the UK, as far as I can see. I just wish we had enough of a market environment in the UK that domestic companies didn’t need foreign investment to grow.

Yep it would be nice. Although as long as it stays UK IP and is by a fully firewalled British subsidiary, manufacturing and designing in the UK I’m good.

Interestingly the EU does actually have an incase of fire break glass clause in which if the shit hit the fan and a nation was acting against it, it does have a law which it can enact which simply repeals all internal IP related to that nation ( the EU steals all its IP it can get its hands on ) and bans all its goods and services from the EU market….

Prior to the Helsing acquistion, Blue Ocean Marine Tech Systems Pty. Ltd. is an Australian company not a UK company.

Hmmm Lots of anxiety and angst in the comments about the need to preserve UK IP and/or the prevent the acquisition of UK defence industry companies by overseas firms.

Not too many qualms about UK companies taking over innovative Australian companies and Australian IP.

Good news for the Royal navy and good news for Plymouth.