The Pentagon’s accelerated plan to boost missile and munitions production marks a “foundational reset†in United States defence strategy, according to analysis by Bloomberg Intelligence.

The research suggests that missile procurement funding could rise by 30 percent or more if the Department of Defense moves ahead with plans to more than double production across 12 critical munitions programs.

The Pentagon has reportedly tasked industry with achieving a 2.5-fold increase in output over the next two years to prepare for a potential high-intensity conflict with China by 2027.

Bloomberg Intelligence stated that the shift reflects “a foundational reset in US munitions strategyâ€, with Lockheed Martin, RTX (formerly Raytheon Technologies), and Northrop Grumman positioned to benefit from what analysts describe as a “multiyear growth runway and a possible valuation rerating.â€

According to the analysis, the Pentagon’s Section 890 “TINA Lite†pilot programme will enable streamlined contracting for munitions deals over $50 million, reducing cost and pricing data requirements. The policy change, signed in July by Peter Guinto, Director of Price, Cost and Finance at the Office of the Under Secretary of Defense, is intended to accelerate procurement cycles and expand industrial capacity.

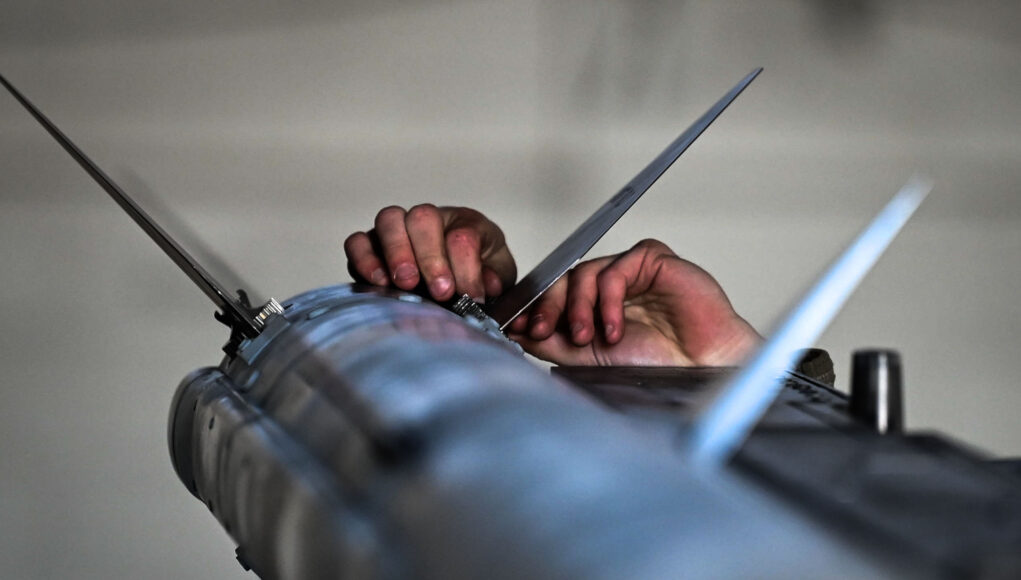

The report noted that the US may currently lack sufficient stockpiles of critical munitions to sustain a major conflict, citing gaps in missile production and supply chain resilience. It also identified Lockheed’s PAC-3 interceptors, JASSM, LRASM and PrSM, and RTX’s SM-6 and Tomahawk missiles as priority systems under the Pentagon’s new Munitions Acceleration Council, led by Deputy Secretary of Defense Steve Feinberg.

Bloomberg Intelligence calculated that incremental costs for the expansion could reach up to $9 billion, on top of the $28.3 billion requested for fiscal 2026 missile and munitions procurement.

Lockheed Martin’s missile and fire control business was highlighted as a major beneficiary, with projected production increases of up to 50 percent by 2027. RTX is also expected to gain from expanded SM-6 and Tomahawk output, while Northrop Grumman’s Advanced Anti-Radiation Guided Missile (AARGM) and Stand-in Attack Weapon (SiAW) were identified as growth drivers amid international demand.

Emerging entrants such as Anduril and the Prometheus Energetics joint venture between Kratos and Rafael are expected to play roles in alleviating solid rocket motor bottlenecks that have constrained production. Bloomberg Intelligence described the overall Pentagon initiative as a broad effort to rebuild munitions stockpiles and prepare US industry for sustained near-peer competition.

Better late than never.

I somehow think integrating Meteor or anything else not ‘made in the U.S.A.’ on the F35 is going to be a priority. Any advance on ‘another five years’?

Doubt it given the present Dicks in government.

present dicks maybe but they are putting their own nation first. would be refreshing if our leaders put our people first

But they aren’t, they are putting themselves first

That’s a very short sighted view, it is vital for the defence of the United States that it has as many allies as possible and they are as well armed as possible, making money for US industry out of selling weapons incapable of doing the required job is a very short sighted view. Many in the US may be deluded about World Geopolitics but that shouldn’t mean we should fall into this potentially disastrous mindset. The are many potential large scale and ominous threats that in reality the US could not possibly resist alone. The Russia/China (+hangers on) alliance would be one if it were to behave in a unified manner which as China reaches its economic and technological supremacy which many economic and technology experts are claiming, thanks to Trump’s internal policies, is now ensured, may make them more inclined to bring about. Even more concerning is what happens with the wider SCO for which Putin is trying to turn into a counter to NATO even with a joint military command. Then there is BRICS which will increasingly become a great and wide ranging power broker of its own, the potential of which is ultimately unknown but is only encouraged by Trump’s naive self destructive actions. Both of these have established well over 25% of the World’s economic activity and over 40% of the World’s population. It’s nuclear deterrent might allow it long term to survive in an increasingly irrelevant bubble but equally an increasingly impotent World player. The US needs all the support it can get and if it is using carrot and stick in pursuance of that to enlighten others to the dangers then great, But I don’t think on present evidence that is the major influence it’s more about weakening others to exploit profitability for him and his business mates over whom he is aiming to exert as much coercive control at the same time to further his and his background strategists aims of forever control. So they rely on him for that profitability and power even as most of the Country suffers, but then they are in the plan kept under control by the various official/unofficial military cohorts he is increasingly bringing under the MAGA banner.

I fear personal and national ambitions will simply through neglect make the dangerous World even more threatening and allies (if they remain) less able to resist it. Only then will the US realise just what a paper tiger they have become and far too late.

AIM-260 is supposedly the number 1 priority

Oh, … How surprising.

Indeed spent years keeping the best Air Defence missile off of the F-35 just so they can sell their new white hope that finally at least matches it to the masses when it belatedly arrives. Europe simply can’t allow this process to continue longer term, it’s unsustainable outside of becoming colonised client states of either the US or the growing enemy coalition of the United States, not exactly a compelling choice. Self sufficiency is ever more important, until alternatives to the F-35 fly that’s going to be a tough one however.

When i pointed out some months ago that F35, F35 weapons integration and AIM-260 are all LM, i got called a conspiracy theoryist because everything even US missile integration is held up by block 4. I just think block 4 issues are a happy coincidence(not the 1st time a LM program has suffered delays due to software integration glitches).. i wouldn’t be surprised if block 4 is fixed and implemented around the same time that sufficient AIM-260 stocks have been acquired.