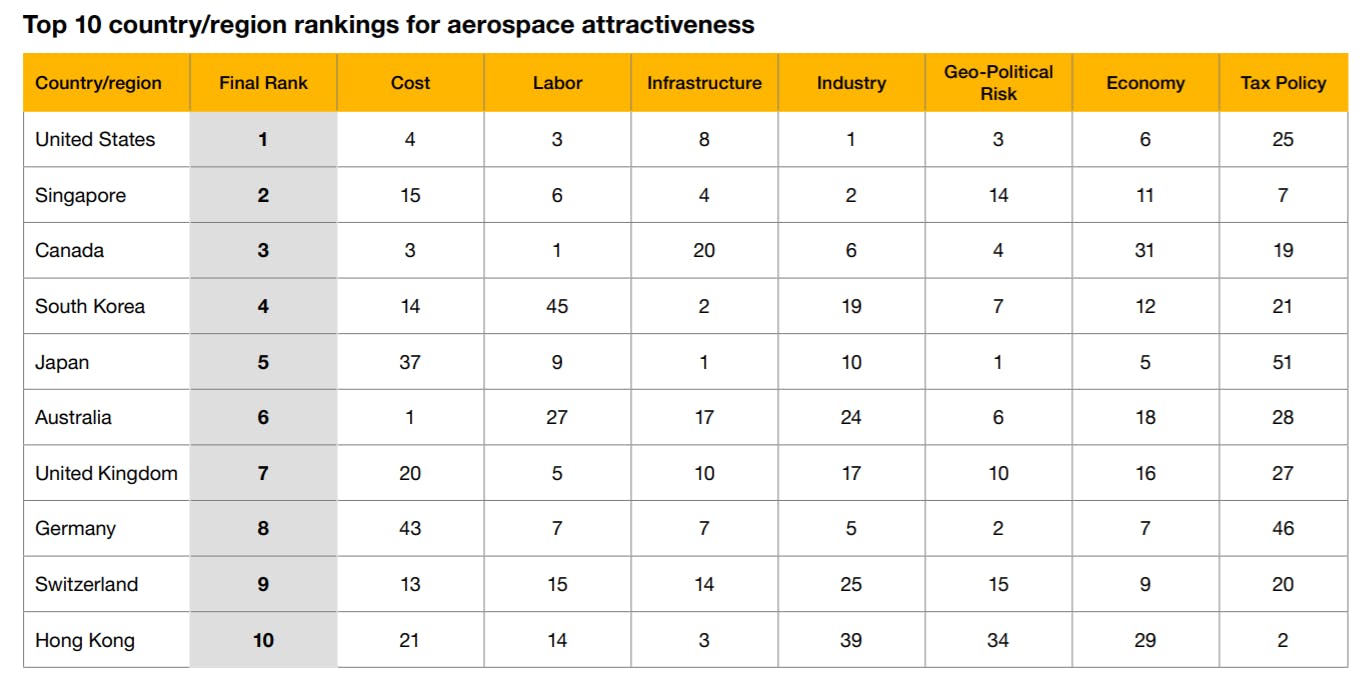

A new PricewaterhouseCoopers report that assesses the attractiveness of aerospace manufacturing investments globally has ranked the UK 7th out of 100 countries and as the top performing European nation.

The UK was ranked 7th in the world in the global study with Brexit and COVID-19 related challenges playing a role in the drop from the previously held position of 4th last year.

The 2020 Aerospace Manufacturing Attractiveness report assesses a range of aspects such as cost, economy, infrastructure, labour, industry, and tax policy. Crucially it also analyses geopolitical risks such as Brexit, and it is this lingering economic uncertainty – alongside COVID-19 – that has been a factor in the UK’s drop from 4th position in 2019.

The top three spots this year are held by the US, Singapore and Canada with South Korea, Japan and Australia leapfrogging the UK to take 4th to 6th positions respectively.

Germany, the Netherlands and Hong Kong complete the top 10 nations.

According to the analysis, the biggest shifts for the UK were in the cost category (from 4 to 20) and the industry category (from 8 to 17).

“This is in part due to Brexit trade challenges that continue to impact the UK A&D industry, particularly in relation to supply chains, EU funded research and development investment, access to skilled workers and strategic business partnerships with EU-based companies.

The pandemic also exacerbated a rash of challenges earlier this year, including cash flow and liquidity, resulting in proactive government support, supply chain disruptions and, naturally, unprecedented revenue shortfalls. The report notes that while the return of air travel demand could take as long as three to five years, defence infrastructure investment has been more resilient during this period.”

Roland Sonnenberg, head of UK aerospace and defence at PwC, is adamant that despite the uncertainties ushered in by these challenges, the UK remains an attractive hub for aerospace manufacturing.

“Both the Government and industry in the UK recognises the significant contribution that the aerospace and defence sector makes to creating a highly skilled workforce, innovative products, and advanced engineering capabilities that are valued globally in the export market. But the industry must double down to compete, continuing the investment in skills and technology, particularly with the aim of reducing our carbon footprint, if it is to continue to unlock the UK’s capabilities and bolster its attractiveness as a trade and investment partner for the EU and other nations.

As Brexit looms and COVID-19 continues to takes its toll on the aviation sector in particular, it’s heartening to see the Government acknowledge what a dynamic and exciting industry this is with ongoing support such as the Future Flight programme, which will receive up to £125 million from the Industrial Strategy Challenge Fund to take commercial advantage of the future technologies. The National Aerospace Technology Exploitation Programme is also designed to improve the competitiveness and productivity of small and medium sized companies.”

There are fewer than 50 working days until the end of the Brexit transition period, at which point the UK will leave the EU customs union and single market.

“We don’t have full clarity on tariffs yet but, regardless of the outcome of negotiations, change is coming in a matter of weeks.”

Businesses must be ready to move goods, people, and data differently from 1 January, including making customs declarations on all goods moving between the UK and EU – whether that’s individual components, sub-assemblies or finished goods.

“Greater clarity is urgently needed by the sector which employs highly integrated supply chains and where even a marginal cost increase could make all the difference to the health of an organisation and its ability to compete.”

Roland Sonnenberg, concluded:

“In what is a tough economic environment, it is critical that trade is as free as possible as we move into this new era. Organisations must also take appropriate steps to ensure they are ready to move people, goods and data differently in 2021. Until the pandemic hit, the industry’s principal focus over the last 20 years was growth – but now is the time for priorities to change. Businesses have an ideal opportunity to take stock, adjust their strategic priorities, and focus on their immediate cash flow and working capital challenges so they are in robust health and able to react swiftly when markets improve.

Firms that build on their immediate response to the pandemic and shifting Brexit challenges, demonstrating market-leading innovation and agility, will be best positioned to outpace their competitors in the months and years ahead.”

The report notes that the UK’s Foreign Direct Investment (FDI) flow hit its lowest mark in six years during 2019, with the number of foreign investment projects dropping by 14% to 1,782 — marking the second consecutive annual fall since March 2017.

What a load of BS. This study completely fails to consider the most important factor of all, tech know how. Singapore 2nd really? Where are China, France, India, Russia, Sweden? countries that actually build planes!

I agree, just another way of managing data to produce meaningless statistics.

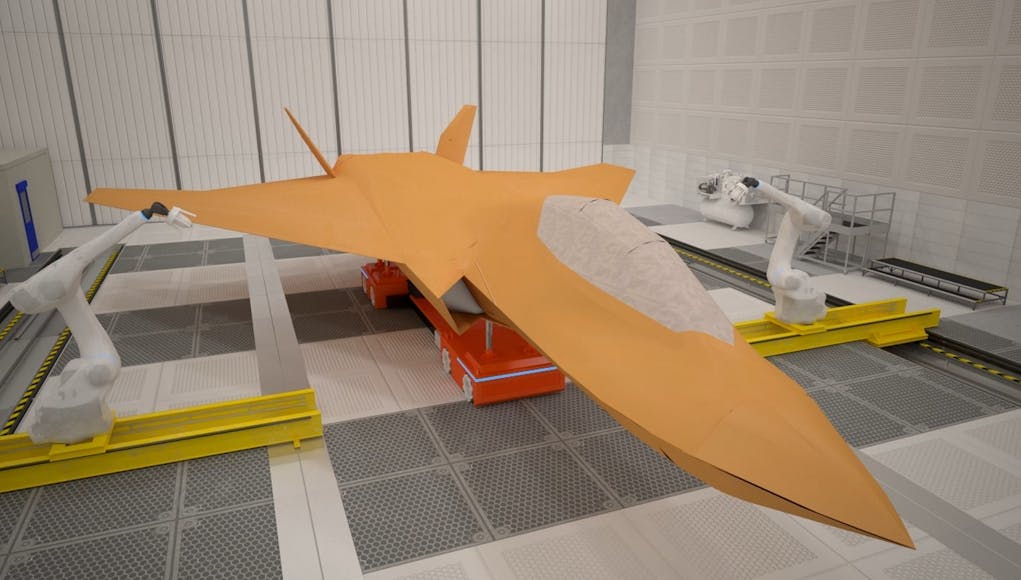

What is interesting though is that they have used the BAe image for the Tempest. BAe have stated that they are going to produce 30% of the aircraft using 3D printing. They are definitely confident the 3D printed materials will stand up to repetitive approval testing. Does that mean they will be using a new process or material I wonder?

3D printing is going into surprising (to me) places now e.g. one of our very own U.K. rocket companies, Orbex, is 3D printing rocket engines – https://orbex.space/vehicle

SpaceX also uses some 3D printing for its Super-Draco thrusters and I think (but can’t find a source) that it is also using 3D printing for some individual components in its newest (still under development but has done 2 short test hops to date) Raptor engines that are real beasts.

On materials here is something I found regarding SpaceX’s materials for its Super-Draco 3D printing, interestingly an article written by a UK company so I don’t know if they actually supply additives to SpaceX or if they are simply in the same market – (Come to think of it I’ll post this second link in a reply to myself below because I think > 1 link gets a post flagged as needing moderation.)

Here’s the UK/SpaceX additive link – https://www.pesmedia.com/spacex-3d-printing-kingsbury-uk/

Cheers, always thought the sintering process meant that the object wouldn’t have been as strong as if, the object was machined from solid stock. The blurb states that they use sintered inconel for the engine chambers. These get furring hot, so the 3D process must be working. Great strides have been made, so it’ll be interesting to see what BAe produce for Tempest?

The PwC focus will be facilitation of investment opportunity and returns alongside technical potential. In aerospace, I get the impression that Germany still desires the UK as a military partner post Brexit, if at all possible.

PwC is a pro remain entity then.